Integrations

Integration enhancements

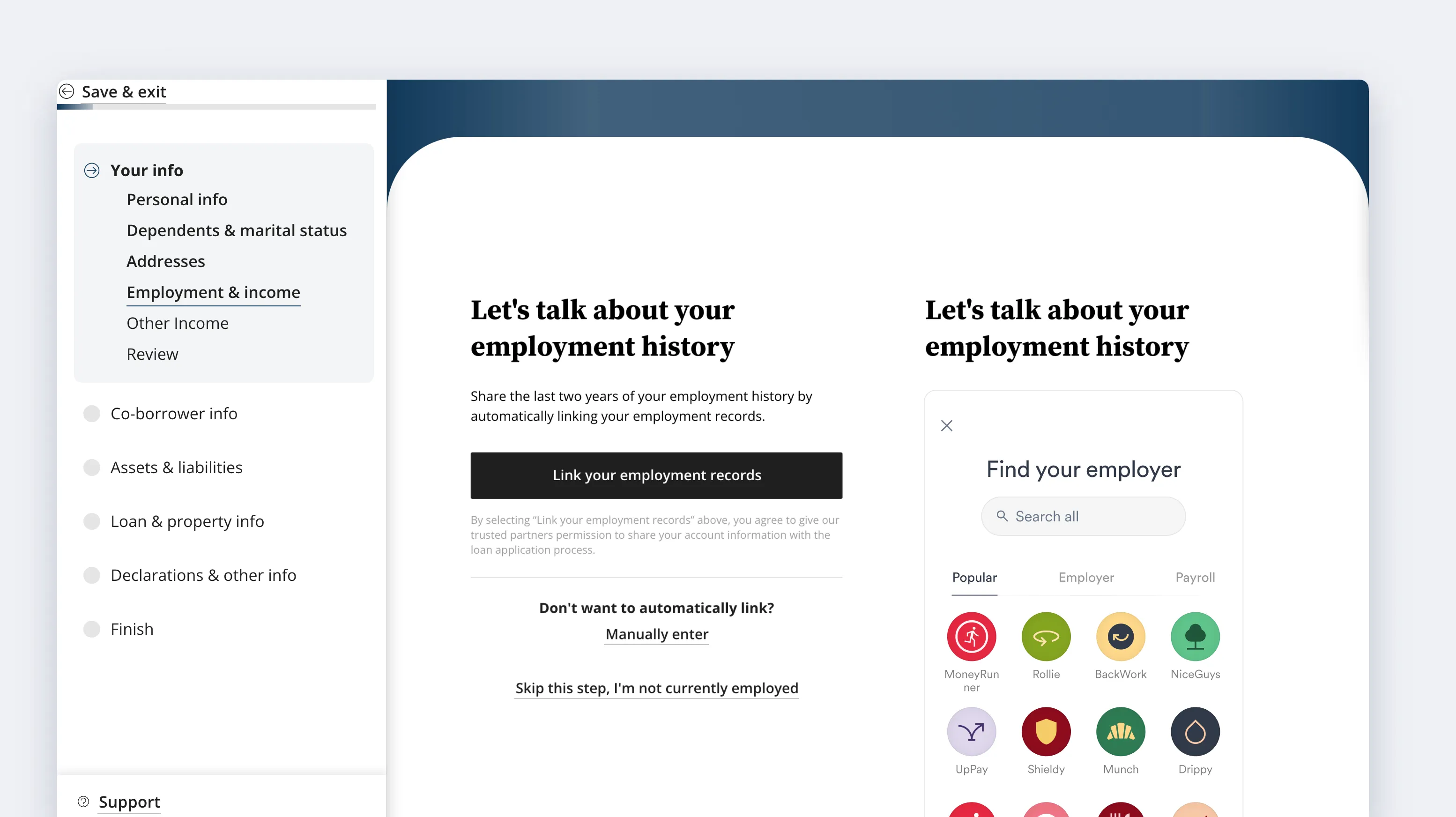

Argyle is now embedded within nCino, plus enhanced interoperability with Encompass.

Mortgage borrowers can now seamlessly connect their payroll accounts via Argyle within nCino when completing the Employment & Income section of their loan applications.

- Direct-sourced data populates the application for a faster, less-error prone workflow.

- Automatically obtain paystubs, W-2s, and GSE-approved verification reports.

Argyle is also introducing complete interoperability between nCino and Encompass® by ICE Mortgage Technology®.

- Documents and verification reports based on nCino connections can be passed directly to Encompass®.

- URLA and GSE provider fields will auto-populate in Encompass®, simplifying submissions to automated underwriting systems (AUS) like Fannie Mae’s Desktop Underwriter® and Freddie Mac’s Loan Product Advisor®, while enhancing rep & warrant relief eligibility.

Reach out to your nCino and Encompass® customer success managers to enable these Argyle integrations today.